What we learned at SME Finance Forum in Amsterdam

The SME Finance Forum is a global network, working on bringing together financial institutions, technology companies, and development finance institutions to share knowledge, boost innovation, and promote the growth of SMEs.

It is managed by IFC, a World Bank organization. It gathers variety of Financial institutions and MSMEs profiled as data resources and analytical companies. Most of them are Fintech companies, which are innovative and on some way Bankers see them as a threat for banking sector. This year’s Global SME Finance Forum examined the different ways in which the real sector has entered the SME finance space. It checked the various ways in which financiers and regulators are trying to satisfy and regulate finance needs at any stage of business process.

Sefini Consulting attendance at SME Finance Forum in 2019

It was related to presenting and introducing Q-Lana Inc. They introduced their own product Q-Lana – a Knowledge-based SME lending platform for the banking and similar financial sector, which was one of the exhibitors at the Marketplace.

It was related to presenting and introducing Q-Lana Inc. They introduced their own product Q-Lana – a Knowledge-based SME lending platform for the banking and similar financial sector, which was one of the exhibitors at the Marketplace.

Therefore, apart the plenary sessions and workshops at the Forum, we were talking to bankers and other managers who might have interest in Q-Lana solution. We talked at the booth or on meetings scheduled by application Brella with a limits to 15 minutes per meeting.

Funding Circle Study tour

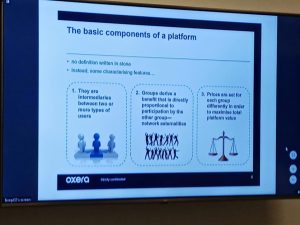

Besides, we had the opportunity to visit the Fintech company Funding Circle on the third event day, which is a start-up company that has developed a platform for linking and matching MSMEs in need for loans from one side and investors, private and legal entities willing to lend to specific projects, from the other side. Managers from the Funding Circle explained their business model. They told the story of how they started and managed in growing their business. The company was founded in the UK, then spread to the USA, Germany and finally the Netherlands. It is about technology innovation in lending process, dealing through the platform with application of risk management algorithms in assessment, but with human evaluation as well. So, Funding Circle doubles the assessment process. This means, the machine assessment is checking by people, who eventually correct results.

What is evident is that demand for loans exists, while in parallel, there are people willing to invest their money in business loans and for entrepreneurship projects need. The platform is here to link both sides, provide business presentations, assess and calculate risks and scores, track repayments and alert on defaults. Benefits have both sides through interaction, and through back-end support. Managers are there to react and intervene. Hence, technology is easing and fastening the process tracked and supported by experts. I was impressed with the Funding Circle model, as I recognized the microfinance lending process almost the same as we had at Microfinance institution – MFI, but with more automation influence. We at MFI – Micro Development, until 2017, did the same, but more in person with clients, and with Loan Officer appraisal of the loan, but with no algorithms.

Microfinance in Future

What if we had the opportunity to work as a Microfinance institution nowadays, we would need to implement and use the benefits of new technology and digital solutions, but would not neglect to set the personal relationship with clients. Then to track and support entrepreneurs and their businesses, online or in person. The point is the same. Entrepreneurs and small businesses needed then and need now financial sources. Most of them choose lending, which is nowadays pretty affordable. Technology contributes the process. Businesses satisfy their needs and grow. The whole society benefits at the end. Credit management Platform or Crowdlending Platform have become and will prevail in Microfinance industry.

Comments are closed.